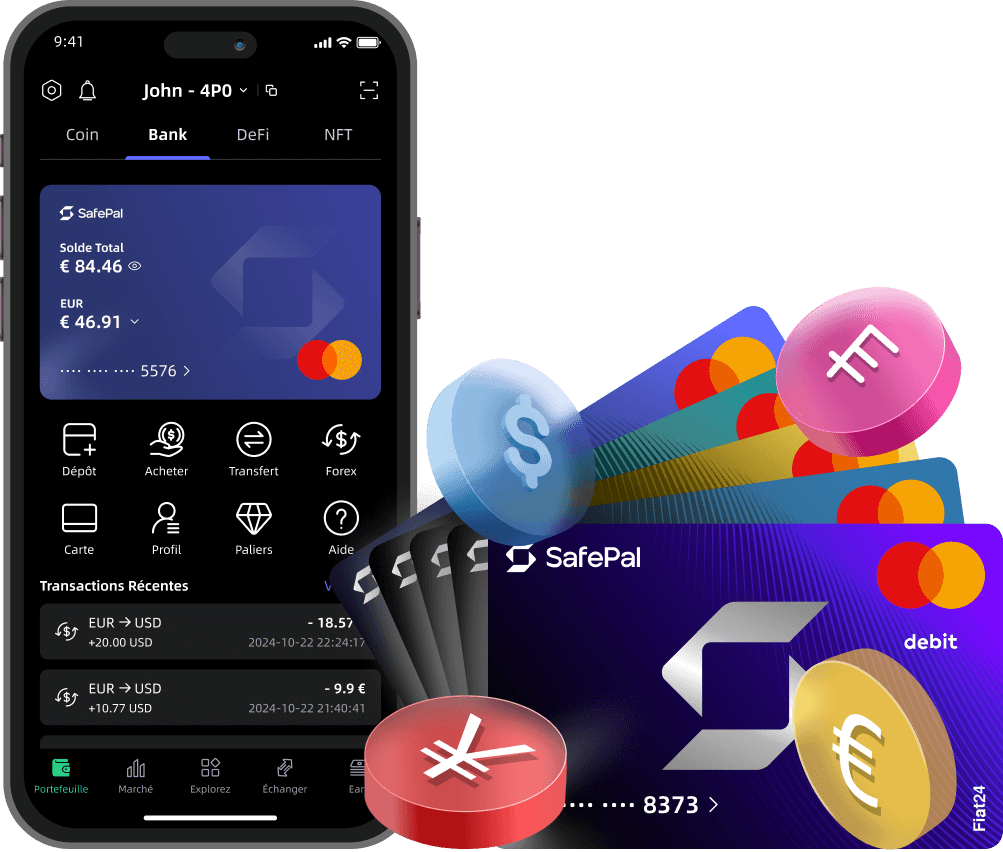

Les utilisateurs ouvrant un compte via la passerelle bancaire SafePal profiteront de zéro frais de dépôt et on-ramp. En savoir plus

•

Compte IBAN suisse entièrement conforme1

•

Bénéficier de virements rapides et transparents entre comptes bancaires internationaux

•

Personalisé vos limites de dépense pour une sécurité avancée2

•

Aucun frais d'ouverture et de gestion de compte, ni pour les virements bancaires.3

•

Les frais de recharge en crypto les plus compétitifs, avec des taux à partir de 0,4 %.4

•

Les transactions sont effectuées sur le réseau Arbitrum, dont les frais de gaz sont abordables.5

•

Pas de vérification de crédit ou d'épargne obligatoire d'actifs pour l'éligibilité au compte6

•

Utilisez votre compte et carte instantanément une fois votre compte approuvé

•

Support email dédié et réactif7

•

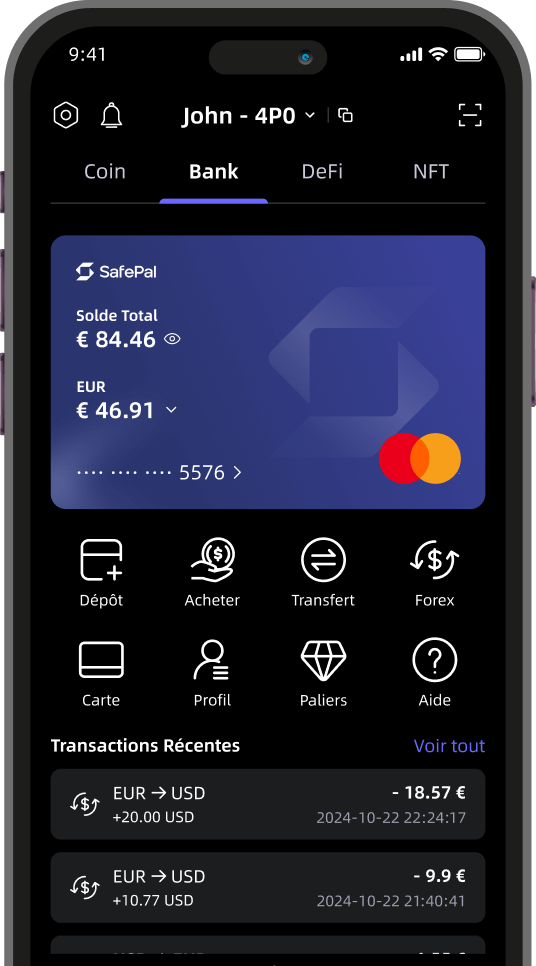

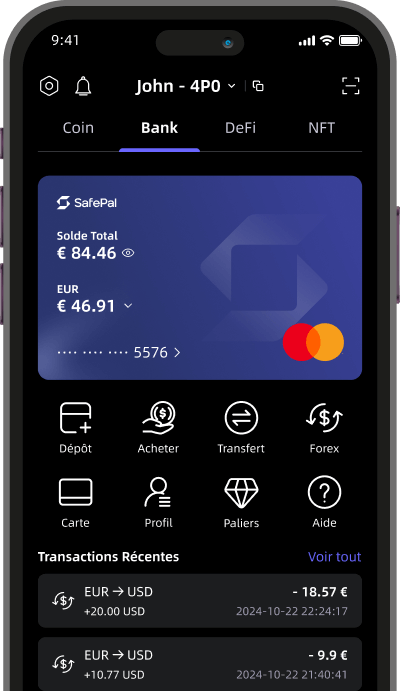

Liez votre compte à une carte de débit virtuel Master, acceptée par plus de 40 millions de commerçants, y compris les plateformes en ligne.

•

Rechargez votre compte avec des crypto sur plus de 40 blockchains en USDC et Fiat pour une utilisation pratique.8

•

Dépenser des crypto-monnaies via des plateformes de paiement populaires et établies telles que Paypal, Apple Pay, Google Pay, Samsung Pay, et plus encore.

•

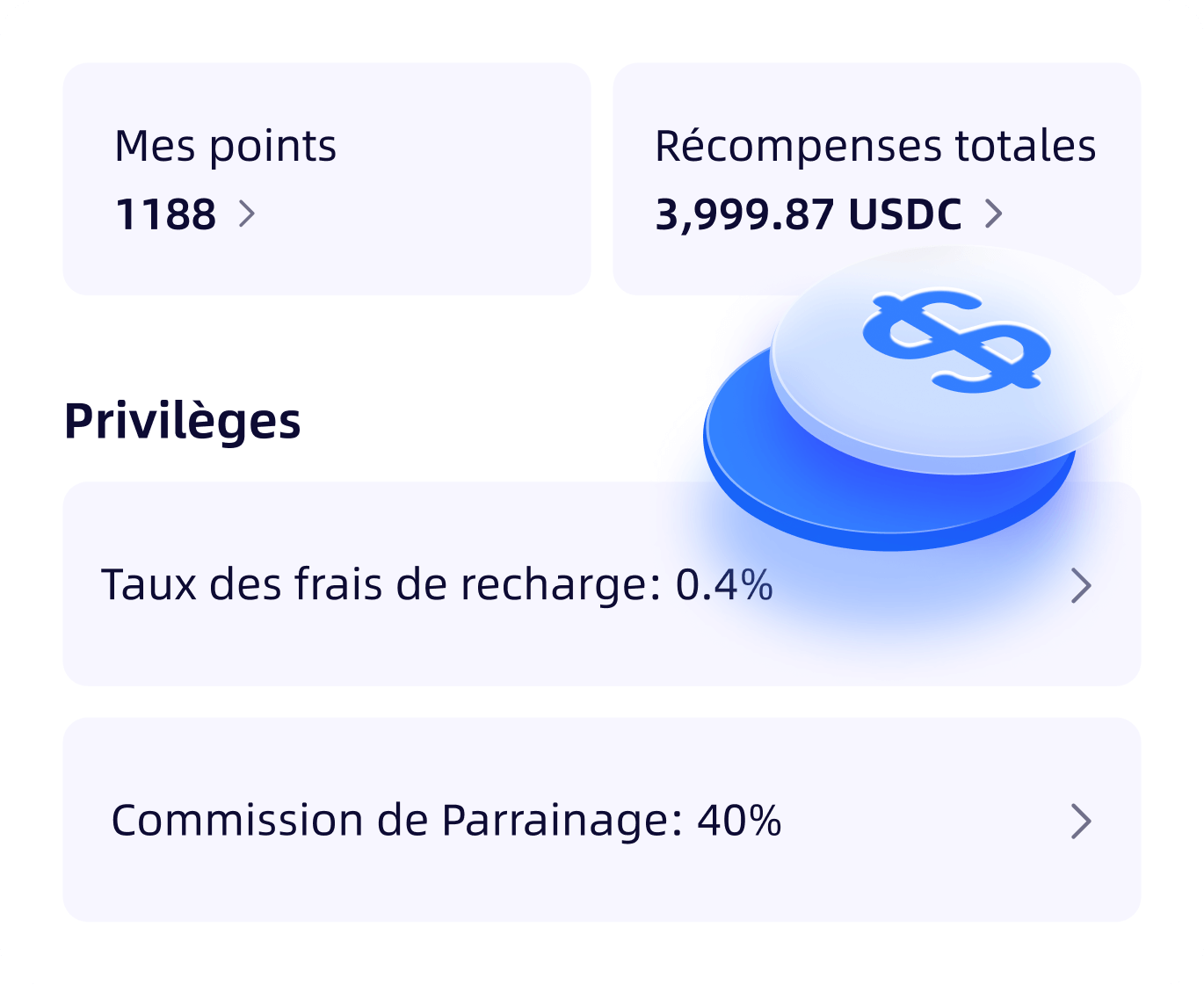

Bénéficiez commissions de parrainage allant jusqu'à 40 % sur tous les frais de recharge des comptes parrainés.9

•

Débloquez des privilèges exclusifs en effectuant des dépôts, en parrainant et en épargnant des SFP.10

Questions Fréquentes

Pour les cartes Master, la limite pour les paiements sans contact est de 1 600 EUR par jour et de 5 000 EUR par jour pour les autres modes de paiement. La limite mensuelle est la même que la limite de transaction.

Pour plus de FAQ et de conseil d'utilisation, visitez notre Centre d'aide

1. Le compte IBAN suisse et le service de passerelle bancaire sont proposés en collaboration avec Fiat24, qui se charge exclusivement des aspects de conformité et de licence. Pour en savoir plus, consultezici le site officiel de Fiat24.

2. La limite de dépense fait référence au montant total accumulé qui peut être dépensé par les utilisateurs via leurs cartes Master. Veuillez vous référer au guide ici pour savoir comment les ajuster.

3. Tous les frais sont divulgués de manière transparente lors de l’utilisation du service. Des frais de swap de crypto, frais de recharge de compte ou de dépôt, ainsi que des frais de change fiduciaire peuvent s’appliquer. Bien que SafePal et Fiat24 ne facturent pas de frais de virement bancaire, il peut y avoir des frais d’autres banques lors des transferts depuis ou vers ces comptes bancaires. Un spread s’applique également lors de l’échange de crypto-monnaies. Pour plus d’informations, veuillez consulter nos Conditions tarifaires.

4. Les taux de recharge et les commissions de parrainage diffèrent selon le niveau du compte. Les taux concurrentiels mis en évidence sont basés sur le niveau de compte le plus élevé. Pour plus d’informations sur les niveaux de compte, veuillez vous référer au guide ici.

5. Les frais de gaz sont soumis à l’utilisation du réseau et ne sont pas contrôlés par SafePal. Ils peuvent être plus élevés pendant les pics d’utilisation du réseau ou sa congestion. Pour en savoir plus sur les frais de gaz, consultez le guide ici.

6. Conformément aux exigences réglementaires en matière de licence bancaire et de conformité, des processus KYC et d’intégration sont requis pour les utilisateurs éligibles. Pour en savoir plus sur les exigences, consultez la section FAQ ici.

7. Les utilisateurs peuvent demander de l’aide et poser des questions via le canal dédié ici. Ce système vise à protéger la vie privée et la sécurité des utilisateurs et à minimiser la probabilité d’usurpation d’identité et d’escrocs.

8. $USDC s’agit de la crypto-monnaie de recharge par défaut pour protéger les utilisateurs de la volatilité du marché, et l’exécution ou les transactions sur la blockchaine peuvent être affectées par la congestion ou l’utilisation du réseau. Pour en savoir plus, consultez le guide ici.

9. Toutes les images sont fournies à titre indicatif uniquement, les avantages et récompenses peuvent varier et être ajustés à la discrétion de SafePal et Fiat24.

10. Pour plus di'nformation sur les niveaux de compte et leurs privilèges, les utilisateurs peuvent se référer au guide ici.